Protect What Matters Most

Identity theft can disrupt more than your finances—it can affect your family, your time and your peace of mind. That’s why F&M Bank offers IDProtect®, a comprehensive identity theft monitoring and resolution service available with Power and Signature Checking. With tools to help detect suspicious activity and experts ready to help if fraud occurs, you can feel confident knowing you have added protection for your personal information.¹

Benefits of Identity Theft Protection (IDProtect)

Identity Theft Expense Reimbursement Coverage2

Receive up to $10,000 to help pay expenses, clear your name and restore your identity, should you become the victim of identity fraud.

Comprehensive Identity Theft Resolution Services

Should you suffer identity theft, your very own dedicated fraud resolution specialist will help you every step of the way until your identity is restored.

Debit and Credit Card Registration

Register your credit, debit and ATM cards and have peace of mind knowing you can call one toll-free number to cancel and request replacement cards should your cards become lost or stolen. (registration/activation required)

Credit File Monitoring3

Daily credit file monitoring and automated alerts of key changes to your credit report. (registration/activation required)

Credit Report & Score4

Access to credit report and credit scores. (registration/activation required)

Identity Monitoring

Monitoring of over 1,000 databases. (registration/activation required)

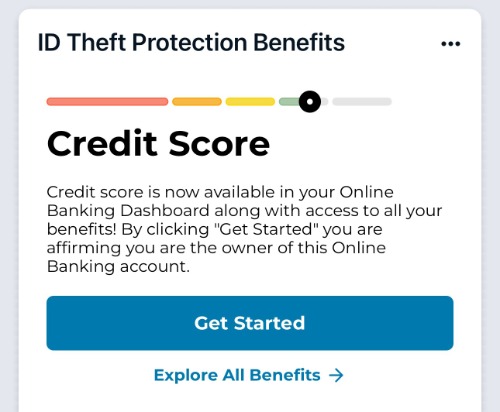

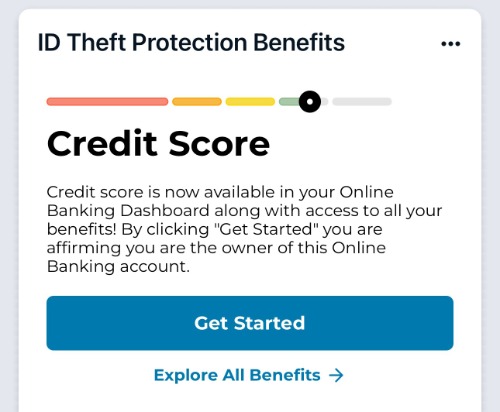

Access Your Benefits Inside Online and Mobile Banking

We’ve made it even easier to stay protected. When you log in to your F&M Bank account, look for the ID Theft Protection Benefits widget on your dashboard.

Here’s what to expect:

Already Enrolled?

-

You’ll see a prompt to “Get Started.”

-

After confirming your account, your credit score will appear right on your dashboard.

-

From there, you can explore all your benefits with just a few clicks.

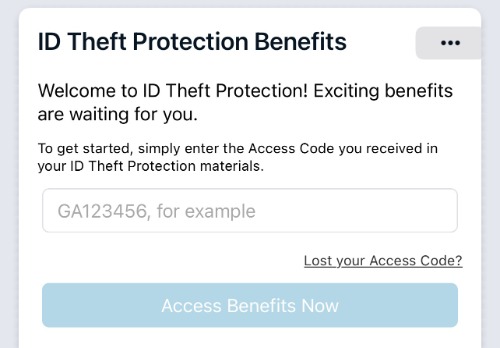

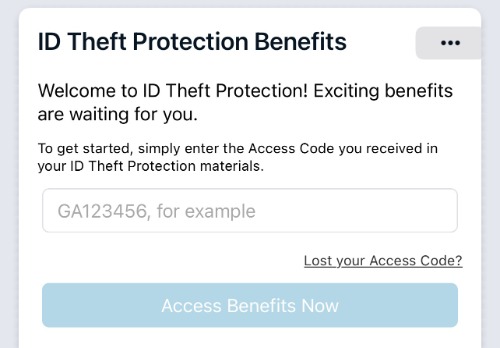

Not Yet Registered?

-

The widget will guide you through setup.

-

Enter your personal Access Code: NC554673 to activate your benefits.

-

Follow the prompts to get started quickly and easily.

Or download the IDProtect app available from the Google Play or App Store, once you are registered on the website.

IDProtect is available with Power Checking and Signature Checking for no charge. Contact us today or visit an

F&M Bank location for more information.

¹Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a "signer" on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: spouse, persons qualifying as domestic partner, children under 25 years of age and parent(s) of the account holder who are residents of the same household.

²Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the insurance document. Insurance products are not insured by the FDIC or any Federal Government Agency; not a deposit of or guaranteed by the bank or any bank affiliate.

³Credit file monitoring from Equifax and TransUnion will take several days to begin following activation.

4Credit Score is a VantageScore 3.0 based on Equifax data. Third parties may use a different type of credit score to assess your creditworthiness.