As a valued F&M Bank Power or Signature Checking account client, you already have access to IDProtect®— identity theft monitoring and resolution service1, including:

- Up to $10,000 Identity Theft Expense Reimbursement Coverage:2 To cover expenses associated with restoring your identity.

- Fully Managed Identity Theft Resolution Services

- Credit File Monitoring:3* Daily credit file monitoring and automated alerts of key changes to your Experian, Equifax and TransUnion credit reports.

- Credit Report:* Ability to request a triple bureau credit report every 90 days or upon opening an identity theft resolution case.

- Credit Score:4* Ability to request a single bureau credit score.

- Identity Monitoring:* Monitoring of over 1,000 databases.

- Debit and Credit Card Registration:* Register your credit, debit and ATM cards and have peace of mind knowing you can call one toll-free number to cancel and request replacement cards should your cards become lost or stolen.

Utilizing these benefits will be easier than ever.

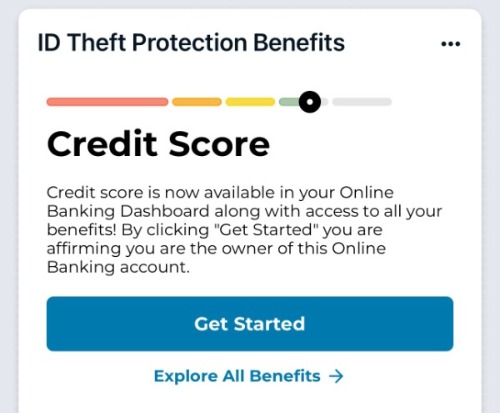

You’ll soon see an ID Theft Protection Benefits widget on your dashboard when you log into your mobile app or online banking. Here’s what to expect:

If you’re already using ID Theft Protection Benefits:

- A new widget will prompt you to "Get Started"

- Once you confirm your account ownership, the widget will begin displaying your credit score (updated quarterly)

- You’ll be able to explore all your ID Theft Protection Benefits—right from your banking dashboard

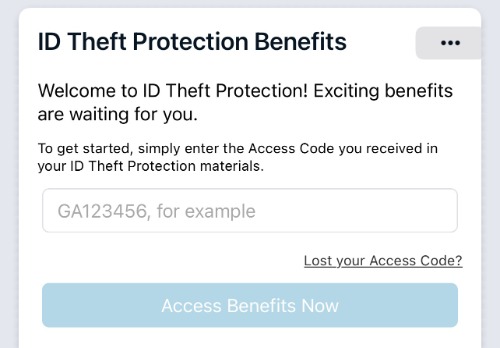

If you haven’t registered for ID Theft Protection Benefits yet:

- The widget will ask you to enter an Access Code to activate your benefits

- Your Access Code is: NC554673

- Once entered, you’ll be guided through the setup process

Have questions? We’re here to help—contact us at or stop by your nearest F&M Bank office.

DISCLOSURES:

* Registration/activation required

1Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account owner who are residents of the same household.

2 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Guide to Benefit and insurance documents can be found through your online banking or mobile app or at FMBNC.idprotectme247.com. Insurance Products are not insured by the FDIC or any Federal Government Agency; not a deposit of or guaranteed by the bank or any bank affiliate.

3 Credit File Monitoring may take several days to begin following activation.

4 Credit Score is a Vantage Score 3.0 based on single bureau data. Third parties may use a different Vantage Score or a different type of credit score to assess your creditworthiness